Non-gaming, User Acquisition

This user acquisition strategy for non-gaming apps never works

Aug 6, 2024

Non-gaming, User Acquisition

If you’ve been running ads on social and search in hopes of securing thousands (or millions) of users for your new app, you probably aren’t getting the results you expected. I know there are UA marketers who manage to find success with a witch’s brew of content marketing, social media, and search, but this concoction is not likely to drive the intended results for the majority of apps. While it may work for apps that are created as an extension of an existing successful business, app-based businesses cannot rely on social and search alone to succeed.

That isn’t to say that social and search shouldn’t be part of a broader user acquisition strategy. They have their place. Both channels can work well, but they should not be the backbone of your user acquisition strategy.

When people scroll through their social feeds – whether they’re doom-scrolling or looking for their next dopamine hit – they probably don’t want to stop doing what they’re doing to download your app. That’s not why they signed on to Instagram, TikTok, or Facebook. They came to see what their friends are doing without them, what Taylor Swift wore on the red carpet, or what the cool kids are topping their cloud bread with this week. If you do want them to leave the platform, you’d better have content compelling enough to click through.

Generally, though, users want to stay on the platform and keep scrolling.

That isn’t to say that social media ads don’t work – of course they do. (That’s why there are so many ads in your feed!) But social media should definitely not be the backbone of your UA strategy. If you do decide to promote your apps on social, here are a few tips to get the most out of your campaigns:

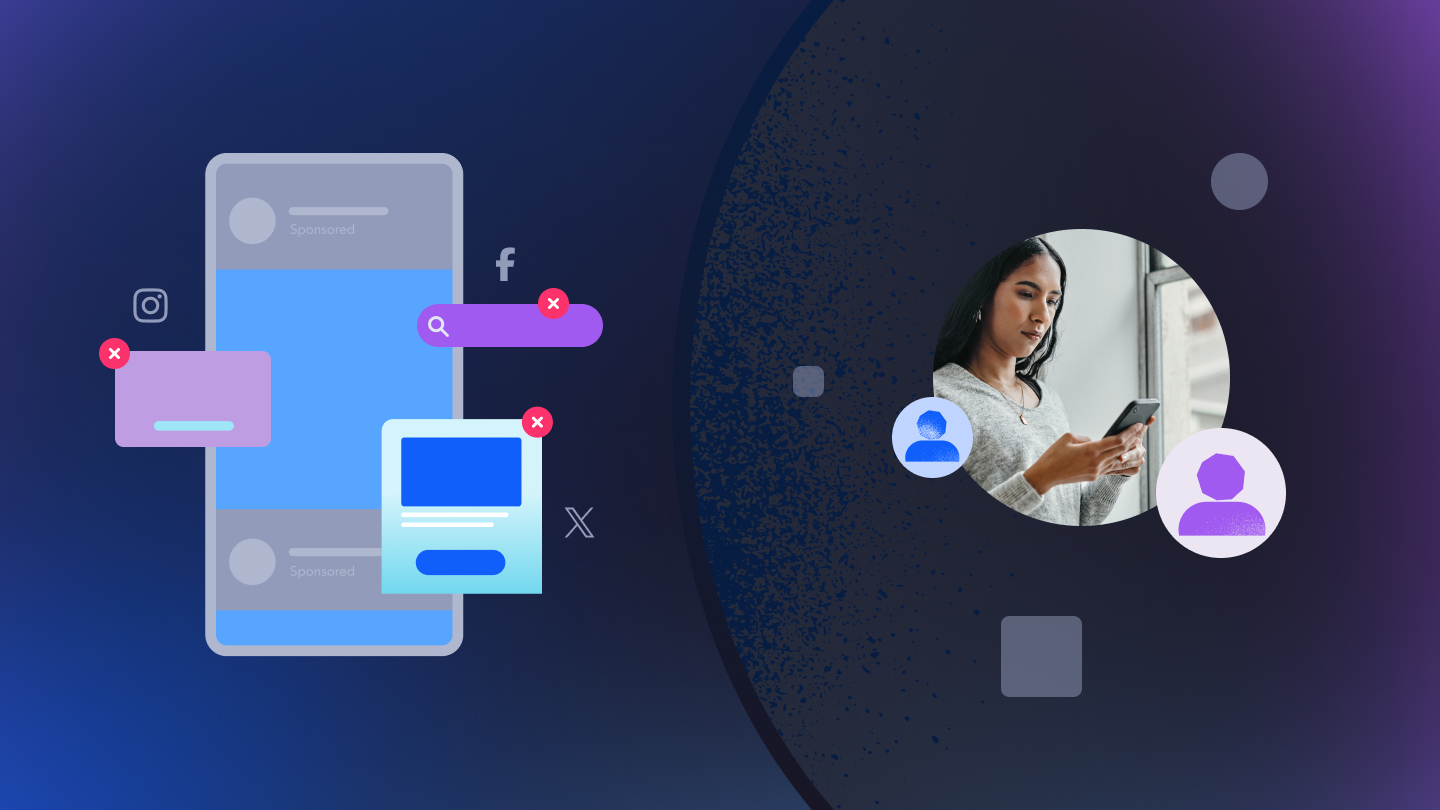

Source: Accion Opportunity Fund

All of the social platforms offer their own analytics, which you can combine with app store analytics and your own mobile attribution platform.

The challenges you’ll face on social media platforms are already well-known. The first is scalability. While the number of Facebook users, for example, continues to grow, users only spend about 30 minutes on the platform daily. That’s not a huge window of time to capture attention, especially with how much competition there is for every user’s attention.

This may be the reason why fewer agencies are investing in social media. As Digiday reported:

After 81% of agency pros told Digiday last year that they purchased advertising on Facebook on behalf of clients in the past month, just half (50%) said the same this year. And Instagram saw a similar drop, from 81% who said last year they’d bought ads on the platform for clients in the last month to 48% who said so this year…this is another indicator that agencies might not have seen good ROI on ads purchased on Meta’s platforms last year, so they pulled back a lot on purchasing ads on Facebook and Instagram this year.

So social media should be part of your strategy, but it certainly shouldn’t be your only UA channel.

Search engine marketing (SEM) has always been a great channel for targeting customers at various stages of their journey. Search is essential for users who know your app and just want to find and download it: You want users to be able to type in any conceivable spelling of your app’s name, find your landing page or app store listing, and download.

Long-tail search is even more important. Users searching for whatever your app does – whether it’s counting calories or identifying house plant maladies – are going to be your best prospects. Anyone typing in “best app to identify plant diseases” is a user you want to capture!

The in-between terms are where things can get sticky. Buying terms that reference your app’s category can be competitive and expensive. For example, the term “dating app” sees nearly 140,000 searches per month (per Semrush) in the US alone, making competition for visibility on that term difficult and expensive—even at $2.29 per click.

The term “best online dating apps for seniors” sees considerably less competition, and likely, higher conversion, but the cost-per-click (CPC) is about $12. With an average click-through rate of 3.15% and an average conversion rate of 4.4% on Google Search, cost-per-acquisition (CPA) comes in at approximately $272 – and that’s assuming that search is your only touchpoint. But, of course this would be part of a campaign with both higher and lower-priced keywords with various search volumes – and even then, the CPA would be relatively high. This makes it difficult for smaller companies with limited budgets to compete with larger studios that have more substantial advertising budgets.

Source: WordStream

Beyond the cost, SEM campaigns require continuous monitoring and optimization to maintain performance. There are a lot of levers to adjust: keywords, creatives, bids, negative keywords. There is no “set and forget” with large-scale search campaigns. Successful campaigns require daily attention, totalling several hours per week. Even with automated bidding, bids require oversight, and negative keywords need to be updated frequently.

Click fraud is also an ongoing concern with SEM. UA managers have to be on the lookout for suspicious patterns that can artificially inflate costs and skew performance data. The search engines have implemented measures to detect and prevent click fraud, but it does still happen. While they will generally refund any budget lost to bad actors, someone has to be monitoring accounts to detect it.

Overall, SEM is an essential tool for UA: When users search for your app in Google or Bing, you want to be among the top results. But it shouldn’t be your only channel, and you definitely don’t want to build your UA strategy around Google Search alone.

It makes sense that the best place to target mobile users is on their mobile devices – and even more sense to target them within mobile apps. Americans spend more than four hours a day on apps – far more time than the 30-40 minutes estimated they spend on Google (3-4 sessions at 10 minutes each) and nearly twice the two hours and 16 minutes spent on social media.

In-app ads directly reach users on their mobile devices, where apps are installed and used. This direct access and level of engagement increase the likelihood of converting ad views into app downloads.

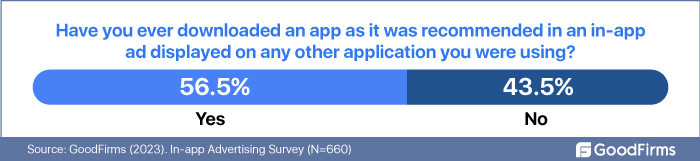

A broad range of interactive and entertaining formats, including playable and full-screen video ads, drive engagement and conversion. These ads tend to surface during appropriate moments in the app experience, so they’re less likely to annoy users. When targeted correctly, they may even be perceived as helpful. In fact, in a Goodfirms survey, 64% of respondents said they found in-app ads useful, and 56.5% said they’d downloaded an app after seeing it promoted in an in-app ad.

Mobile advertising platforms offer advanced targeting options based on user behavior, interests, demographics, location, and even specific device types. This precision targeting helps ensure that ads are shown to the most relevant audiences. AI-powered platforms such as AppDiscovery are capable of targeting the high-value users who are likely to download and keep your app.

Need more reasons to prioritize UA platforms in your strategy? OK, let’s go:

To close things out, while social media and search engine marketing are great tactics for user acquisition, mobile advertising should really lead your UA strategy. Targeting users where they spend the most time and leveraging a purpose-built platform to help you reach your goals just makes sense.

Need proof? Read this success story and see how AppDiscovery outperformed social platforms by 2X for SmartNews, or how Experian acquired a ton of new users at their target cost-per-event (CPE).