Mobile App Growth, Monetization

Capturing the Upturn: Holiday Spend Driving Renewed Growth Across the Mobile Ecosystem

Dec 12, 2023

Mobile App Growth, Monetization

The holiday season has traditionally been a lucrative time for ad monetization as Q4 means higher CPMs and expanded holiday budgets. Following the ATT policy shift in 2021, the mobile advertising landscape has had an impressive rebound, demonstrating a strong resilience and upward growth trajectory.

We’re sharing publisher trends observed on MAX to illustrate this growth. It’s clear that there’s anticipation surrounding this holiday season as Q4 2023 is already outpacing the growth of Q4 2022. Thanksgiving weekend performance surpassed every year since the launch of MAX in 2019, with overall spending on the platform growing nearly 10% year-over-year (YoY)1.

Higher user engagement is fueling a noticeable uptick in DAV (Daily Active Viewers) and technological advancements, such as AI, are resulting in a CPM surge, which in turn, is amplifying ad revenue. Overall, this means a continued growth trajectory that’s evolving into a big win for the publishers and the mobile ad ecosystem as we wrap up 2023.

Below are key factors driving this growth for publishers across different regions and app categories.

When looking at comparative metrics between 2022 and 2023, we see much stronger returns for app developers this year based on a couple of factors:

In the US, for example, ARPDAU has grown by an average of 7% YoY for the month of November.

Actual ARPDAU numbers have been removed from this graph for confidentiality reasons

To understand this better, let’s take a look at an example within the gaming apps sub-category. A key observation is the significant growth in hybrid casual games. For example, over Thanksgiving weekend, casual games saw a 23% increase in revenue compared to the previous year.

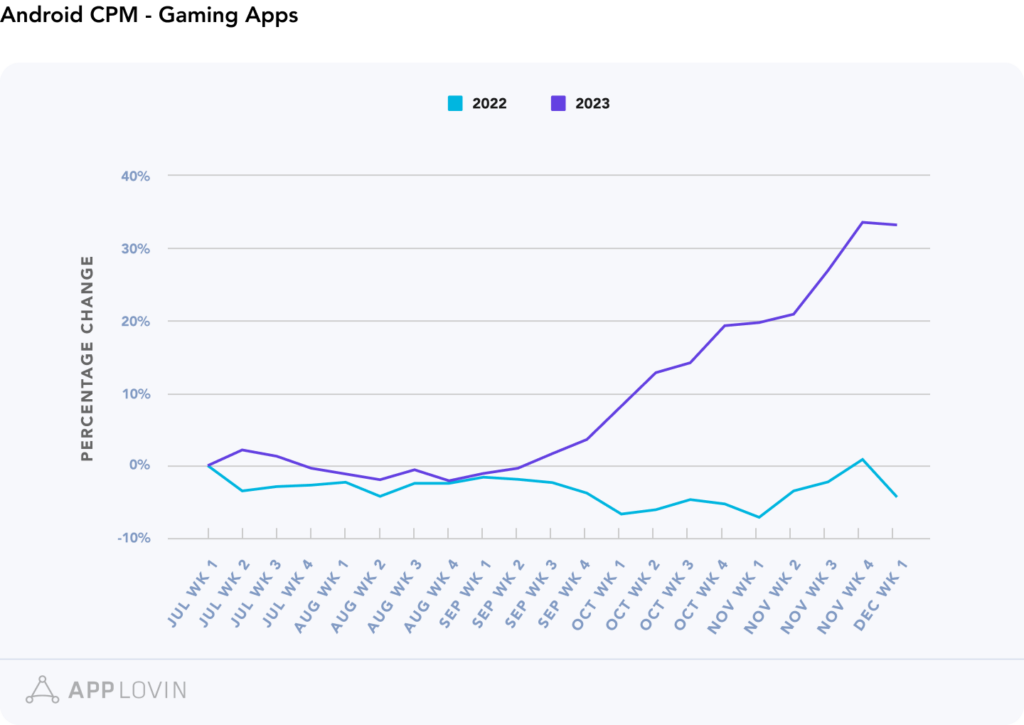

The post-ATT phase resulted in plateaued growth for many app developers. However, comparing this year’s holiday season trends with the previous November, we see significant eCPM growth, with even stronger momentum on Android devices.

From the summer months extending into the crucial end-of-year period, there is a greater increase in performance compared to last year. For example, Android rates during the Thanksgiving holiday last year were in line with CPMs at the beginning of July. However, this year has shown significant growth, with CPMs rising by 33%1 – even outpacing results in 2021.

On iOS, CPM growth during the same period was 13% vs 9% in 20221. As the graphs below illustrate, this performance is not limited to Thanksgiving, as the following week continues to outperform the prior year.

Our findings underscore growth in key areas — from user engagement to monetization — identifying two primary catalysts:

This promising growth that we are seeing for MAX publishers shows not only how the entire mobile ad ecosystem is intertwined, but also that advertiser scale is yielding publisher growth and vice-versa. This is a clear win-win scenario fueling a cycle of growth that the entire industry can benefit from. We are encouraged by this outlook, the pivotal role that AppLovin plays in holiday advertising revenue, and the implications this has for the growth of the larger mobile economy.

1 AppLovin Internal Data, 2022-2023