Industry News & Events

How Amazon is Changing Japan’s eCommerce Landscape

Aug 15, 2018

Industry News & Events

With some 82.6 million ecommerce users today, and another 6 million expected to be shopping online by 2021, Japan is the #2 ecommerce market in the Asia-Pacific region. For years, the market has been dominated by regional brands, including Rakuten. But Japan’s love for online shopping hasn’t quite made its way to mobile yet. In fact, only about 7% of all ecommerce transactions in Japan are made via mobile today. In contrast, mobile accounts for more than 24% of transactions in the US. So why is Japan lagging behind in mobile ecommerce?

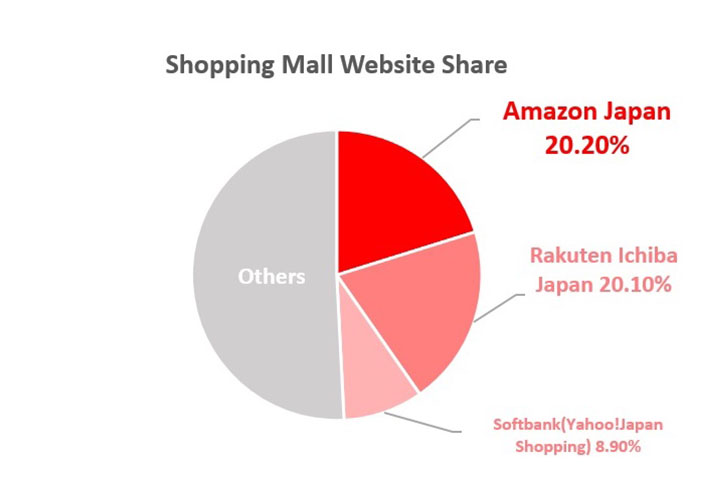

Despite high smartphone penetration and a modern economy, an aging population and embedded trust in traditional financial transactions have slowed Japanese adoption of mobile transactions. But a generational changing of the guard is now underway that will create enormous opportunity for brands, both foreign and domestic. Seeing this opportunity, Amazon has begun pushing hard into Japan over the past few years, and it recently surpassed Rakuten as the #1 ecommerce platform.

btrax: 2017 E-Commerce Trends in Japan

Amazon’s success in Japan has inspired a new generation of Japanese brands to adopt similar business models in key growth categories, including fashion, which is expected to become the top category of ecommerce purchases with an estimated 32 billion in annual revenue.

Driving this change is a rising generation of mobile natives who are turning to fledgling mcommerce brands and apps for their convenience and deals. This mobile-savvy and more risk-tolerant generation will push the Japanese mcommerce market to make the leap from less than 7% of total ecommerce revenue in 2017 to more than 50% by 2021. To understand how, let’s examine Amazon’s business model and consider the way it is influencing Japan’s new generation of mobile brands, marketers, and consumers.

Amazon’s lean business model—an online marketplace backed by intelligent distribution—has played a significant role in its growth in Japan. According to RetailNews, “Amazon Japan’s strong investment in its own distribution centre network is paying off. Amazon Japan has 12 centres and four Prime Now centres, making it easy for the e-tailer to sell directly via its marketplace vendors.”

The success of Amazon’s model in Japan has been so disruptive (Japan has now become the second largest foreign market for Amazon, behind only Germany) as to alter not only ecommerce market landscapes, but the financing, building, and marketing of new shopping technologies in Japan.

One example of the new wave of Japanese mCommerce platforms is Zozotown, a homegrown online apparel retailer with a slick mobile app and a market cap north of $9 billion. The unique spin on the Amazon model is the Zozosuit app, which helps customers order custom-fit clothing to have it delivered.

Zozotown’s local competitor, Uniqlo, uses a similar model, with the added element of a string of brick-and-mortar stores. Beyond that, each company’s business model is distinctly Amazonian in nature: Provide a great marketplace and nail warehousing and fulfillment.

One iteration on the Amazon model that Zozotown has made is in the way the company curates retailers’ presence on their platform. While anyone can sell their stuff on Amazon, Zozotown “maintains an image of demand and curation by only allowing shops it believes will be able to sell products, carrying almost all the brands popular among Japanese young adults,” according to btrax.

Another thing Zozotown modeled after Amazon is its “pay later” option, which gives customers up to 60 days to make payments on purchases. Some may say that this practice breeds impulse buying (which, in retailer terms, usually means a high rate of returns and refunds), but when Japanese consumers are unhappy with a purchase, they tend to give it away or re-sell it, not return the item. It’s difficult to argue with success, as about 57% of Zozotown’s customers under 30 years old use the pay later option.

These convenient shopping and transactional tools, coupled with the traditional Amazon business model, are purpose-built to resonate with the aforementioned rising generation of influential mobile consumers. So powerful is this demographic of young online shoppers that online fashion purchases in Japan will soon overtake electronics and media as the top revenue-producing category.

As is usually the case with global technology markets, the emergence of Amazon, Zozotown, and others as ecommerce/mcommerce power houses in Japan is a product of the convergence of diverse factors: smartphone device penetration, a changing of generational guards, the evolution of mobile payment systems, and the organic erosion of trust issues and other traditional barriers to market entry.

While the ultralight Amazon business model is not the only successful retailing method in Japan, it is the fastest growing, highest producing, and most-well suited strategy for engaging and commercialing mobile natives in Japan. Any mobile brand or marketer looking to succeed in Japan would be well-served to study and emulate Amazon and Zozotown’s early successes.