Industry News & Events

App Annie: Mobile gaming shows strong growth in Q2 2019

Jul 27, 2019

Industry News & Events

Earlier this year, App Annie predicted that mobile gaming would reach 60% market share by the end of 2019 (up from 51% in 2018). Although we’re only halfway through the year, there’s a good chance mobile gaming can hit that market share number by year’s end.

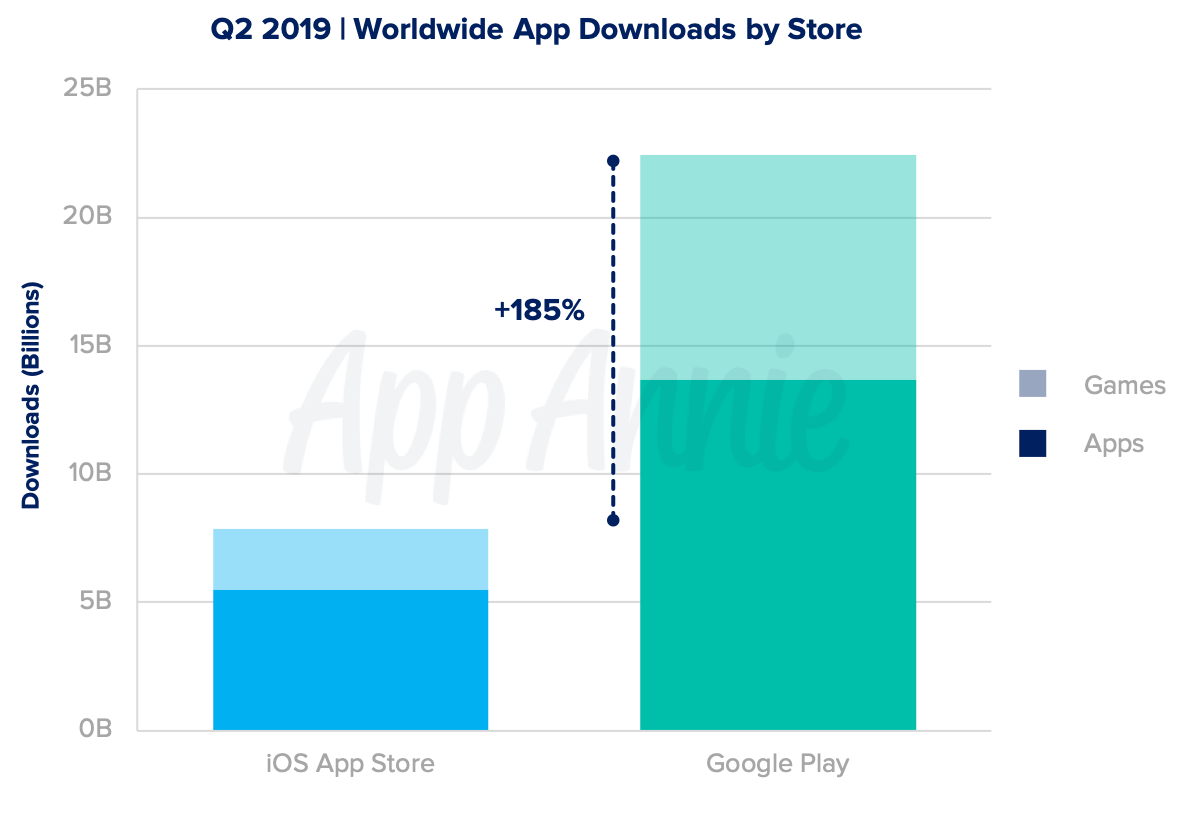

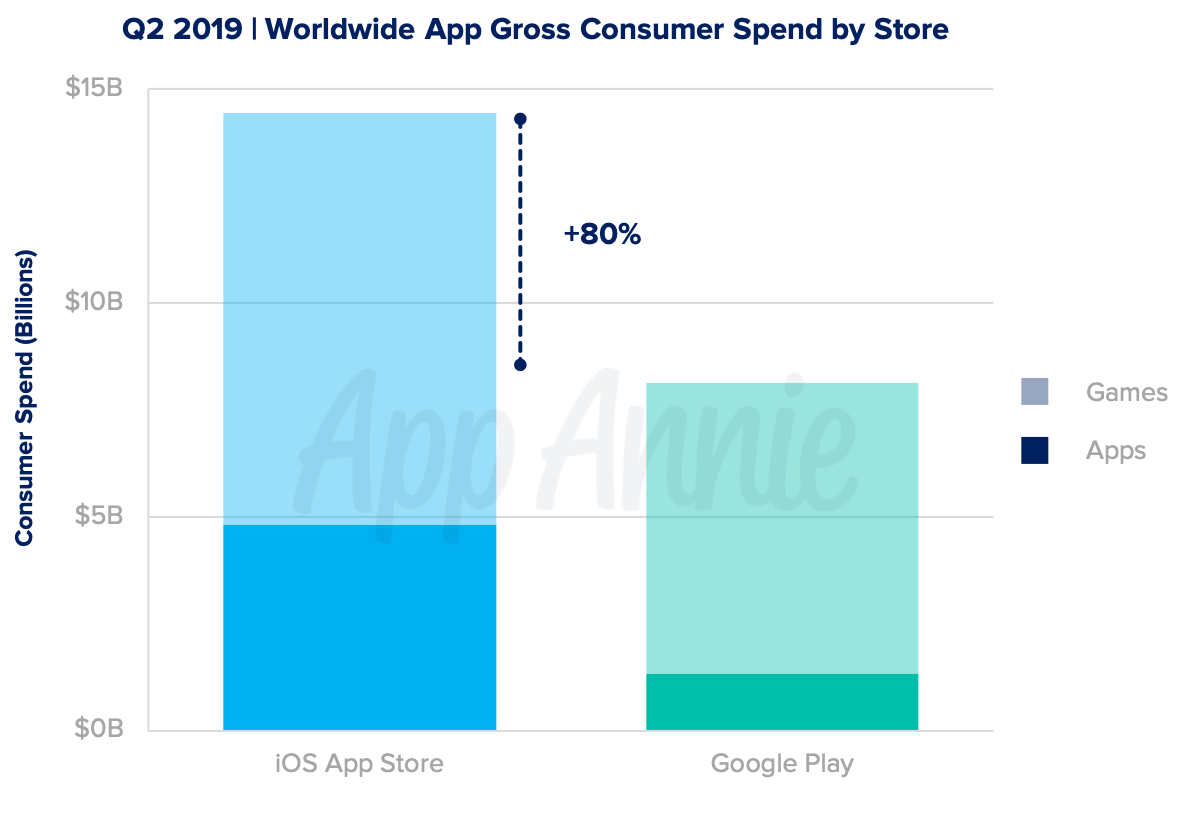

App Annie’s Q2 2019 mobile games report showed record growth in mobile game downloads and spend. One big area of growth was mobile game downloads across Android and iOS. Google’s Play Store leads the App Store by a staggering 265% in game downloads but the App Store still managed to generate 80% more revenue.

Source: App Annie

Interestingly, many mobile game downloads are coming from the US from both stores, even though India, Brazil, and Indonesia lead on Google Play in the past. The United States remains the #1 market for iOS game downloads, outpacing China. However, China beat out the US in terms of consumer games spend on Apple’s platform. The US, Japan, and South Korea respectively were the largest markets for consumer game spend in Google Play but since China has a fragmented Android app store ecosystem, it’s hard to gauge how much money is actually being spent on Android-based games in the country.

Taking a look at the game genres that are performing the best, Arcade, Action, Puzzle, and Casual games lead on Android and iOS. Interestingly, Android users have a higher demand for Casual games while iOS has a higher demand for Puzzle games. App Annie also notes that while hyper-casual games are driving the huge rise in downloads across both stores, it’s hardcore genres like RPG, Strategy, and Action that drove the increase in spending.

Source: App Annie

Hyper-casual games such as Stack Ball, Run Race 3D, Clean Road, Traffic Run, and Crowd City drove the most downloads globally thanks to intuitive and quick gameplay.

Clash of Clans is still performing strong and re-entered the top 10 grossing games in the world. PUBG Mobile also broke back into this list with its huge player base.

Harry Potter: Wizards Unite was a big release by SF-based Niantic, but it failed to match Pokémon Go’s success. Three years after launch, Pokémon Go still ranks #6 by global monthly active users and #9 in global consumer spend. Perhaps the battle of the IPs has been settled.