Gaming

The 5 biggest mobile gaming trends from App Annie’s The State of Mobile 2019 report

Jan 24, 2019

Gaming

The biggest takeaway for mobile game developers is that mobile gaming appears unstoppable. We’ve all seen headlines about declining smartphone sales and how Apple had to adjust their earnings, which the company hasn’t had to do in decades. But mobile gaming is stronger than ever.

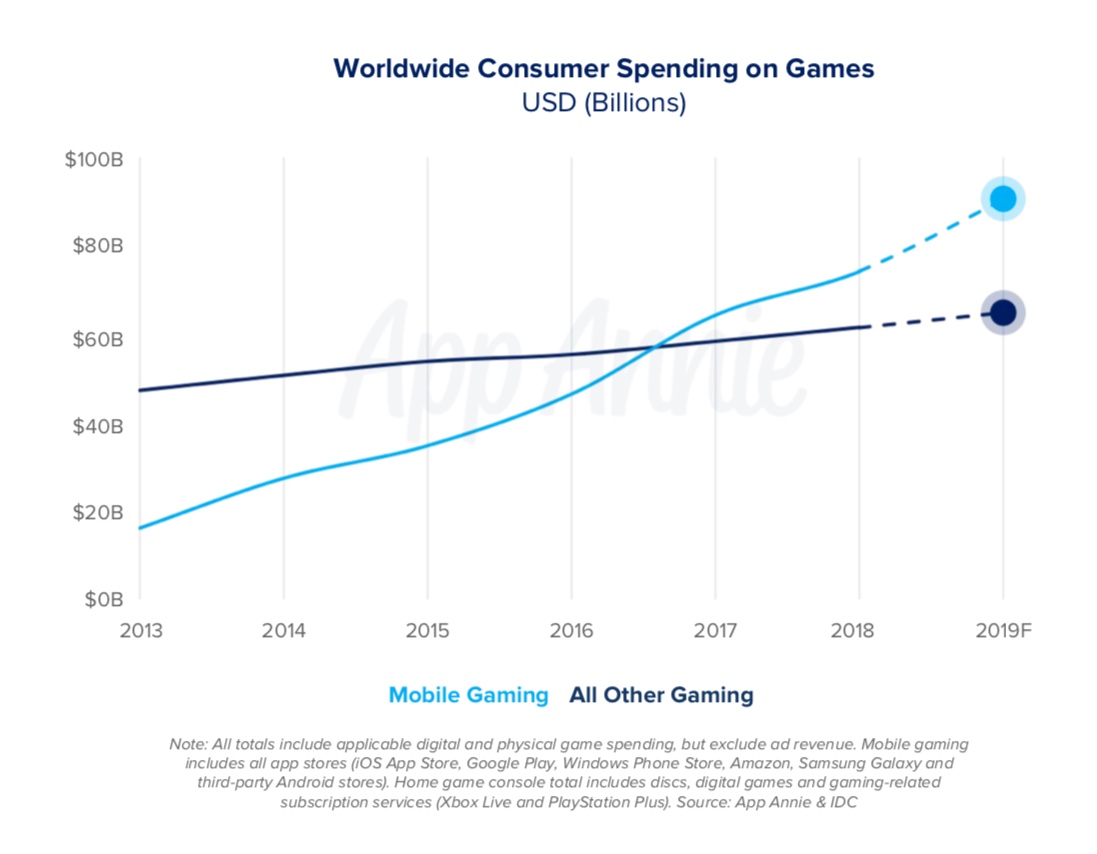

According to App Annie, mobile games accounted for 74% of all consumer spending in app stores in 2018 alone, making it the fastest growing sector in the overall gaming market. Mobile gaming eclipses both the PC and console games market, pulling in $70.3 billion in 2018, which accounted for 51% of the global games market according to Newzoo. App Annie predicts mobile gaming will continue to grow and reach 60% market share of consumer game spending by the end of 2019.

However, mobile game developers will have to deal with increasing competition in and outside the mobile game space. Incumbents like Pokémon Go, Candy Crush Saga, and Clash of Clans still rule the Top Grossing chart on iOS, thanks to unrivaled player retention. Mobile game devs will also have to compete with streaming video services for user attention. If users are watching more streaming video, they have less time to play mobile games, impacting retention for gaming apps.

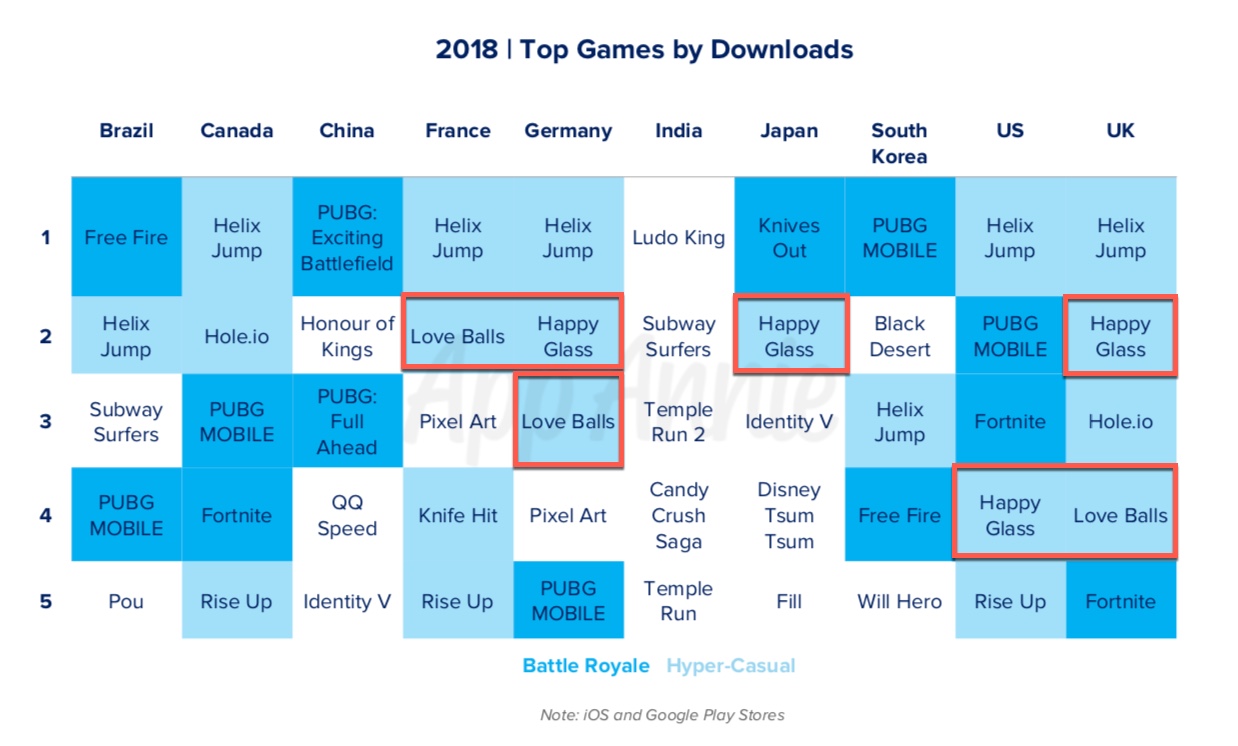

Driving the growth in mobile gaming is hyper-casual and hardcore games. On the casual side of the spectrum, hyper-casual has shown its penchant for producing viral games that climb the app store charts easily. On the other end of the spectrum, battle royale dominated 2018 with games like Fortnite, PUBG, Rules of Survival, and Free Fire. This dichotomy means that mid-core games may continue feeling the squeeze in 2019.

In 2018, we’ve seen Voodoo dominate with hyper-casual titles like Paper.io 2, Grass Cut, and Helix Jump, which are still all in the top 12 free App Store games at the time of this writing. Lion Studios has also seen success with casual titles like Love Balls and Happy Glass. According to App Annie, Love Balls ranked number 6 and Happy Glass ranked number 8 in worldwide downloads for mobile games in 2018.

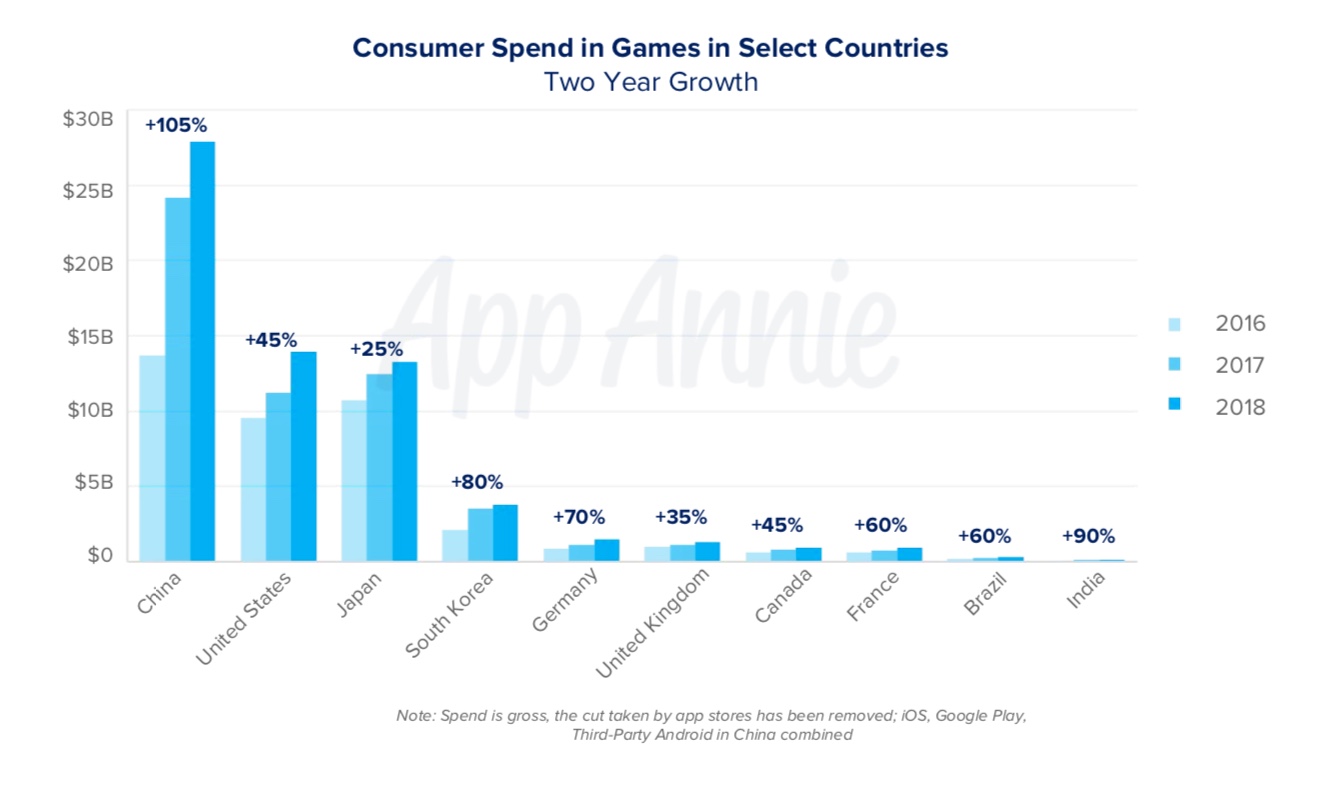

One of the biggest stories from 2018 was the game freeze in China. The freeze was a result of the Chinese government seeking to regulate the games industry for violence, addiction, and dissenting viewpoints. The impact on the games industry was palpable, and App Annie measured a tepid year-over-year growth of 4% for consumer spend on games in China, compared to the global increase of 13%.

The freeze finally thawed in December 2018 but Chinese game developers have been setting their sights on global expansion to combat regulatory hurdles they may face at home. In 2019, expect to see more Chinese mobile game developers look outside their own country to expand their businesses. This means Chinese mobile game devs will have to create games with more global appeal and mid-core and hardcore game developers will have to invest in quality localization.

Hyper-casual and casual games don’t require much localization thanks to their intuitive gameplay and lack of story but the global market is quickly becoming saturated in the casual game sector. The good news is that China has huge potential for casual games, as the game genre hasn’t taken off in the country as much as the rest of the world. There’s some worry about games getting stuck in the approval process but China has sped up its approval process in the past few weeks.

While Chinese developers may be looking to the rest the world, the Chinese mobile games market is too big to ignore, even with the new approval process in place. China is the leader in consumer spending on mobile games by a wide margin, and game developers will continue trying to get into the Chinese market in 2019.

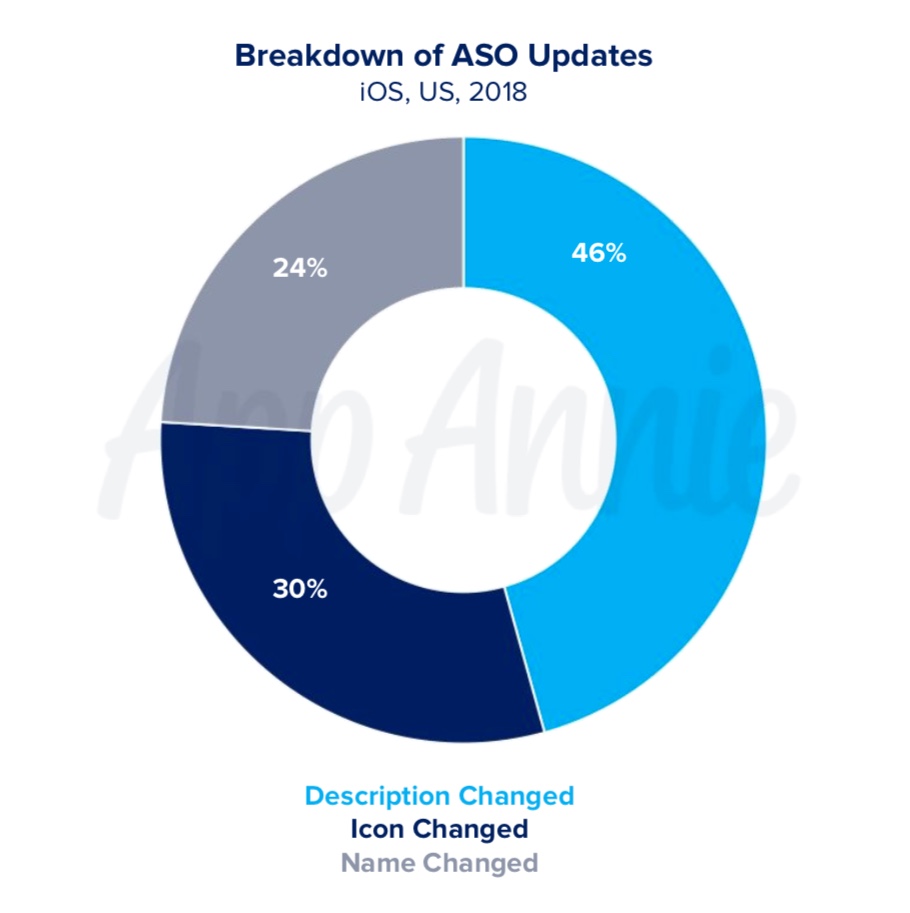

App store optimization remains an important aspect in getting users to organically download your apps. In 2018, App Annie noticed subtle changes in ASO trends, like fewer name changes but an uptick in icon changes (30% in 2018, up from 24% the previous year). The most important aspect of ASO is changing your app’s description, providing keywords and compelling visual assets like screenshots and trailers, with 46% of apps on iOS changing their descriptions in 2018.

For mobile games specifically, this means showing the core parts of your game immediately instead of a cinematic trailer will work best. Mobile game developers should look at what works within their creatives and implement them in their app store descriptions. Video ads that show the most compelling part of a game perform better than a cinematic trailer. Remember, you have a few seconds to grab a person’s attention.

Topical events like holidays and sporting events are easy ways to optimize your game’s app store description, name, or icon. In addition, mobile games see increased retention and monetization from providing seasonal content. This year, mobile spend over the holidays broke records yet again, proving that there’s lots of money on the table when it comes to seasonal updates.

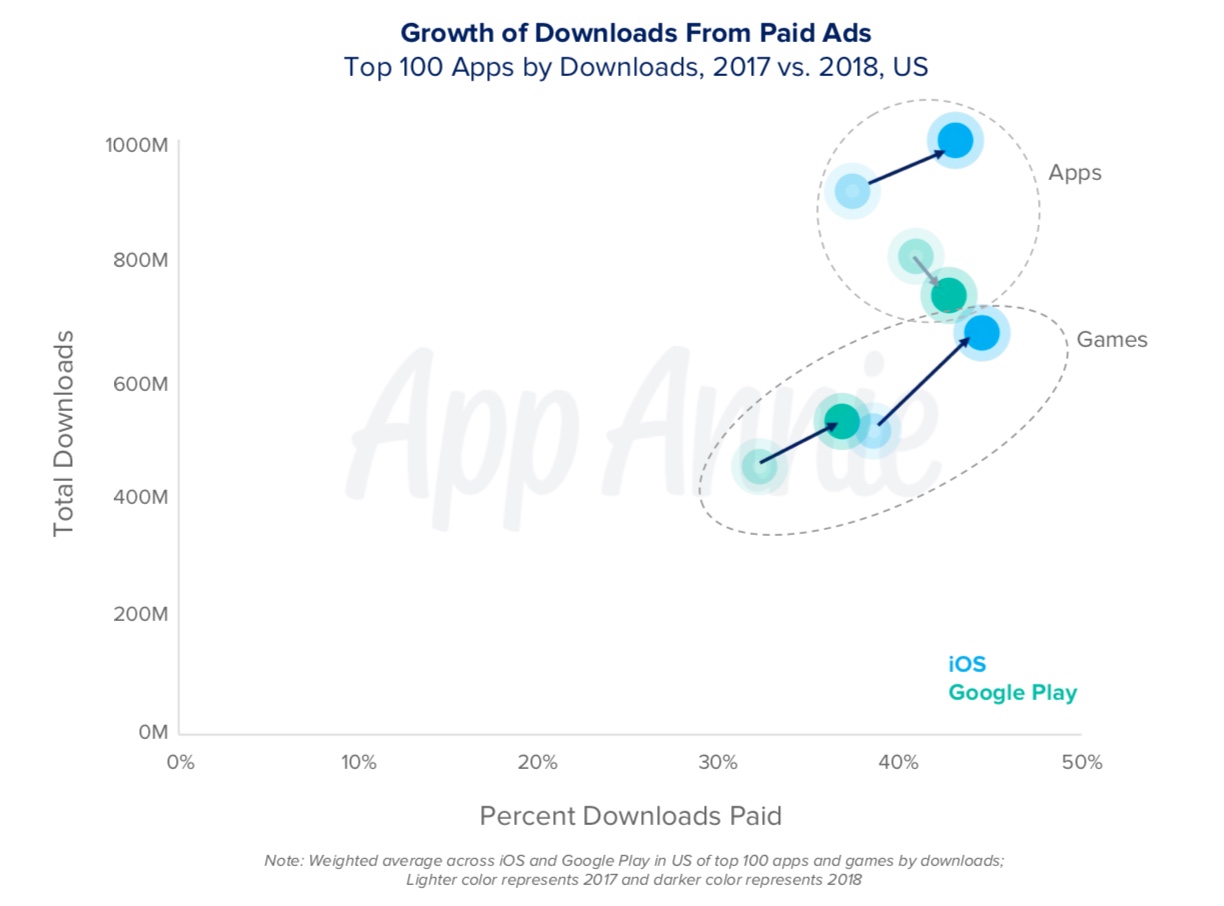

Since gaming is such a saturated market, paid ads are becoming more important than ever. Across Android and iOS, growth in downloads from paid ads jumped significantly.

“Looking specifically at games, 20% more downloads of top games on iOS came from paid UA than top games on Google Play,” says App Annie. The higher spike in paid UA on iOS shouldn’t come as a surprise as the platform has always commanded a premium because its users are more likely to convert into paying customers. With this in mind, mobile game devs can craft specific budgets and create KPIs that help them evaluate the success of each campaign.

On a global level, we’re seeing more game developers realize the importance of paid UA. “The biggest difference between overseas and Japan is that overseas, the reliance on online advertising is close to 100%,” said Tatsuo Sakamoto, head of business development at Lion Studios speaking with developer MagicAnt.

The emphasis on paid UA can also be seen in the increased use of ad platforms within games. App Annie found that games used “45% and 35% more ad platforms on average across iOS and Google Play, respectively.” By integrating more ad networks, mobile game developers can increase their exposure, get better prices, and test more audiences to optimize their ad spend.

There are plenty more insights in App Annie’s State of Mobile 2019 report so download the full report here.